Signed in as:

filler@godaddy.com

Signed in as:

filler@godaddy.com

We are King Makers.... We take a good company and make it Great! In as little as 90 days we have created National $50 - $200 Million+ Companies that demand attention from investors, strategic buyers, Publicly held acquirers, & Private Equity funds!

There is only one way to get a much larger purchase price for your business! Be bigger, much bigger.. The odds of you being a $200 Million+ Dominate leader in your industry that attracts attention from the most well funded buyers is slim to none - until now!

Introducing: Our Group Roll Up For Business Owners who want to maximize their enterprise value and sell quicker!

If you're looking to sell or just wanting a large liquidity event for your business, then you've come to the right place. We can get you a much larger purchase price for your business as apart of a group - than by selling alone!

We take a group of businesses and merge then together as one (On Paper Only) - creating a dominate market leader in it's niche. Once we achieve this status we turn around and sell the group for top dollar - often creating bidding wars from potential buyers.

If your looking for a larger payday or cash exit then your business should apply to be apart of one of our groups.

Our roll up groups are usually by invitation only... But, if you feel your business would be a good fit then you are welcome to apply.

Recent examples:

1. We took 2 nutritional supplement companies and merge then together and immediately within weeks got a $40 Million all cash offer for it from a private Equity Fund. It took only weeks for bids to come in. The highest bid was $40 million all cash.

2. We took 3 Hvac companies in a large regional market; creating one powerhouse Hvac company and it was valued at $22+ Million.

3. We took 3 Dominate Trucking companies and merged them together creating a $100 Million Dollar Trucking Operation.

The Groups we form now are usually $50 - $200 Million Dollar in enterprise value. We create them in a matter of months - which is unheard of.

How would you like to be one of the owners of a $200 Million+ Business & participate in a huge liquidity event in the next 90 - 120 days?

Our groups are formed with a bullet proof protection for every participating business. If the group doesn't sell - you can leave the group no questions asked. Our Mergers are done on paper only. We make no changes - we just position the group to sell at the max price possible. It's a win - win for everyone.

If it does sell - you're looking at receiving a much higher purchase price than you can get by selling alone.

It's Free To Join - No Upfront Fees.

There is Strength in numbers when companies join together for a collective benefit such as; purchasing power, operational efficiency, market defensibility and to get the highest purchase price. Getting the highest purchase price is our main objective!

Private Equity Groups (PEGs) are historically the interim step between main street transactions (less than $5M) and middle market transactions (greater than $50M).

They begin with a single acquisition that becomes their platform and then identify add-on opportunities, assimilate and repeat over 5-7 years until they have a large enough enterprise, with maximized EBITDA, at which point they exit as a middle market transaction or higher.

Because a $5M transaction requires as much effort as a $50M or higher transaction, large buyers look for larger transactions to make efficient use of capital and effort. For example, Berkshire Hathaway (Warren Buffett) will not look at transactions less than $5B even if they meet all of their other acquisition criteria.

The Solution

Crown Star Mergers & Acquisitions has developed this roll up Program to provide Sellers the access and ability to participate in much larger sized transactions and capture value greater than their stand-alone business value.

Utilizing a blind confidential approach, Sellers continue to own and operate their business while we combine it alongside other Sellers into the Roll-Up group and then market the group to buyers as a larger transaction. This eliminates private equity groups from garnishing all of the upside benefits when pooling smaller Sellers over time and instead shares these benefits & large profits with each Seller.

Upon closing, we guarantee Sellers a Premium greater than their appraised value.

Joining one of our roll up groups enables Sellers to capture greater walk away liquidity by participating in a larger transaction and reduces exit fees.

Because our groups are so large, with dominate market positions - we attract attention from all the large buyers - we also leverage them to close faster. Which results in a higher purchase price and a faster close for your business.

We combine your home with a few other homes in your neighborhood into a bundle/package deal and sell the bundle/package deal to a developer as a single large transaction.

The developer will pay a premium for the bundled properties greater than the individual value of each home for access and efficiency of a larger project that they can do more with.

Let’s assume your company is worth $1,000,000;

We will guarantee you $1.2M plus upside.

We anticipate a $1.5M-$2.0M purchase price or a 50%-100% premium for your company.

The buyer will pay the majority, if not all, of the purchase price at close.

We anticipate a minimum cash at closing of 70% of the group transaction which should be equal to or higher than your appraised value with no further risk. There is a good chance you will still retain a small ownership stake of this large group post sale - which means you will likely participate in a 2nd large exit 3 - 5 years down the road when this new buyer builds the group even larger and decides to sell.

Every Seller in the group will get to review the negotiated Purchase price and terms before their final commitment and exit.

You remain in control of your company until the end.

This opportunity is perfect for a seller who wants to transition into retirement over the next few years as opposed to leaving immediately - all though if you want to exit immediately you do have options. We are flexible to accommodate a sellers wishes.

Or maybe you're a seller who doesn't want to retire at all, but you just want to participate in a large liquidity event & continue to operate your business and be a part of something huge - then this will be a good fit for you.

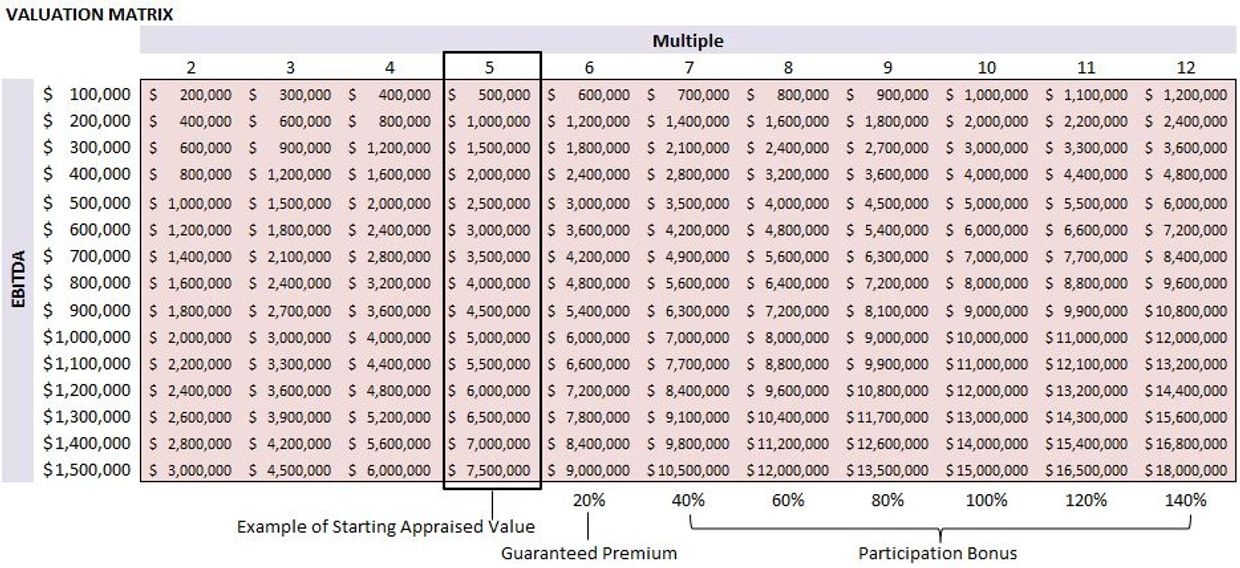

Larger EBITDA transactions enjoy higher multiples. Start with your EBITDA on the left and move across the various Multiples on the right to visualize the potential impact of higher multiples realized as part of a larger transaction. The above example is based on an appraised value equivalent to a 5x multiple.

The reasons a large company will pay a large premium for a large group of businesses.

Instant multiple arbitrage

A public company trading at 23X earnings can easily pay anything less and realize a net gain to the earnings per share.

If they pay 15X for the Pool’s $5M EBITDA or $75M then they realize a market value increase of 23X $5M EBITDA or $115M increase in enterprise value.

Create cross-selling opportunities or instant inroads into hard to get customers/clients.

Accelerates revenue growth to meet or exceed the 20% growth per year that shareholders or investors demand.

With a $5M EBITDA Pool, an acquiring company with $10M EBITDA can grow 50% in a single transaction whereas an acquiring company with $100M EBITDA grows by 5%, etc. a holiday sale or weekly special? Definitely promote it here to get customers excited about getting a sweet deal.

Leapfrog the competition to become the largest player with a single transaction.

Defend your territory from other large buyers or competitors looking to leapfrog your current industry dominance.

The larger the EBITDA numbers the more offers that will come in. Larger deals attract larger, more well funded buyers that can actually close deals fast.

Having a number of offers to choose from gives you more options and better leverage to negotiate to drive a much higher purchase price.

If you are considering selling or exiting your company in the next 6 - 36 months and interested in:

Then our Roll-Up group Program may be the solution for you.

Request mutual NDA for a confidential discussion.

To Request Your Free Report: 7 Steps To Sell Your Business for a Premium fill out the form below.